HILLSBOROUGH COUNTY, Fla. — Many new homeowners in Florida are often surprised by the increase in property taxes associated with their purchase. Additionally, the lack of awareness has caused some to miss out on homestead exemptions.

Recently, there has been a surge in property taxes, which has brought this issue to the forefront. The CDC of Tampa is now helping novice homebuyers get ahead of the curve.

Keisha Lynn said she and her husband did much legwork before buying their new home.

“It was like a good three years of saving, not just for the down payment, which probably is where a lot of people make mistakes. I wouldn’t recommend that because there are a lot of surprise costs in closing,” said Lynn.

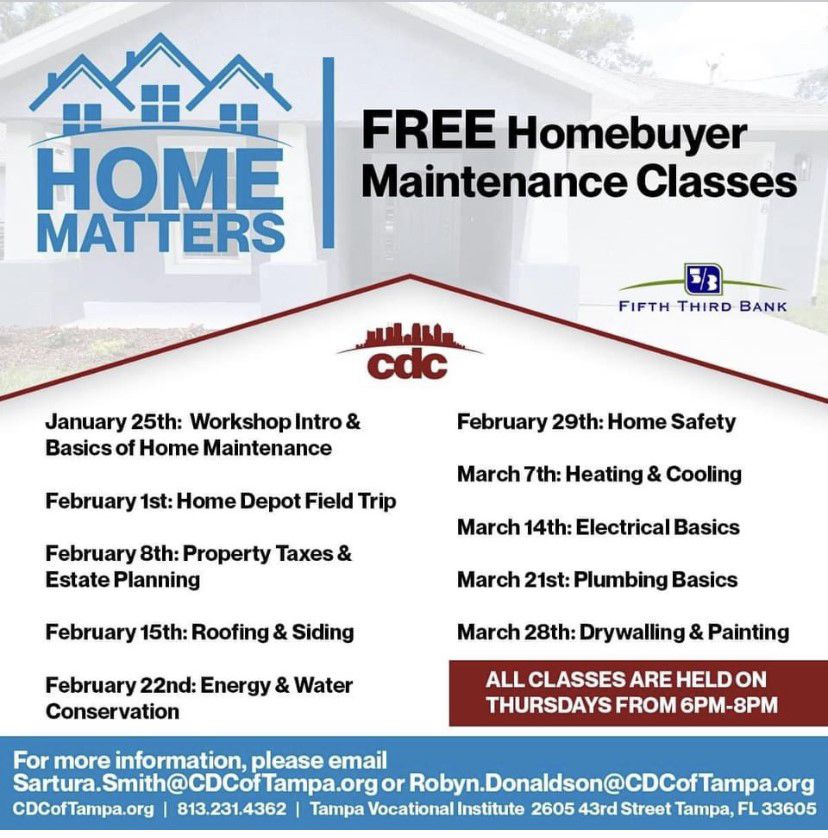

The CDC of Tampa is helping new homebuyers prepare for unexpected expenses through its weekly “Home Matters” classes. These classes cover everything from heating and cooling, electrical work, painting and property taxes.

Hillsborough County Property Appraiser Bob Henriquez, who taught one of the classes, mentioned that according to Florida law, when ownership of a property is transferred, any exemptions must be removed and the property value must be reassessed.

“That’s where that sticker shock comes in. Well, gosh the previous owner was paying $1,600, and mine went to $6,000 - $7,000. So that’s important for them to be informed about that,” said Henriquez.

There was a push in the state legislature this year to bring more transparency to online listing platforms.

“As far as property tax, you never know how much it is going to cost you because I was going based on what was on Zillow,” said Lynn.

Separate House and Senate bills (HB 295 and SB 380) would have mandated those websites to provide more property tax information. Neither bill made it to a full vote, though.

Henriquez says that new home buyers often overlook an essential savings tool: homestead exemptions. These exemptions are available for up to $50,000 for each residence. They are also available for widows and widowers, individuals living with disabilities, veterans and the surviving spouses of military personnel or first responders.

“It’s important that folks, if they are entitled to a break on their ad valorem taxes. We want them to have those,” said Henriquez.

According to Henriquez, property values in Hillsborough County increased by an average of 9% last year. He points out that this increase is proportional to property tax increases and that new homebuyers are not shielded by the “Save Our Homes” cap. This cap limits the annual increase in a property’s assessed value to 3%. As a result, new homebuyers may face higher property taxes due to the increase in property values.

“In the first year that you buy the home. Usually, you are paying what is left of the taxes for the previous owner that may have been protected by the ‘Save Our Homes’ cap,” said Henriquez.

As a mother of six and a new homeowner, Hafza Albatron is always on the lookout for opportunities to save money.

“Everything will be successful when you have knowledge about it,” said Albatron.

Keisha Lynn mentioned that her family can start building equity through their recent home purchase.

“Rent just kept going up and up and up. I’m that person, that went from lease to lease to lease like every year. So I’ll actually learn this address,” she added.

She feels fully equipped with the knowledge to make this purchase her forever home.

Homeowners seeking exemptions must file by March, but property appraisers can accept late applications until September.