The Biden administration on Friday announced a proposal that aims to cancel some student loan debt for about eight million Americans facing financial hardship.

It marks the administration’s latest effort to take on student debt amid a series of legal setbacks and uncertainty.

Under the new set of proposed rules, one could receive relief if the government determines that a financial hardship would impair a borrower's ability to repay a student loan, the Department of Education said in a press release on Friday. Some of the hardships listed as examples that could make a borrower qualify include unexpected medical bills, burdensome child care costs or economic issues after experiencing a natural disaster.

The department is proposing two pathways for borrowers to qualify for the forgiveness. In one case, borrowers could qualify without an application if an assessment, which would take into account household income, assets, balances of student loans and other debt and more, determines he or she has at least an 80% of being in default within the next two years. The other pathway would require borrowers to apply for forgiveness, which could be granted if assessed that he or she is “highly likely” to be in default or face persistent financial hardship and no other relief option exists.

The proposed regulations will be published in the Federal Register in the upcoming weeks and are expected to be finalized in 2025, according to the department.

“The rules proposed by the Biden-Harris Administration today would provide hope to millions of struggling Americans whose challenges may make them eligible for student debt relief,” Secretary of Education Miguel Cardona said in a press release. “President Biden, Vice President Harris, and I will not stop fighting to deliver student debt relief and create a fairer, more just, and more affordable student loan system for all borrowers.”

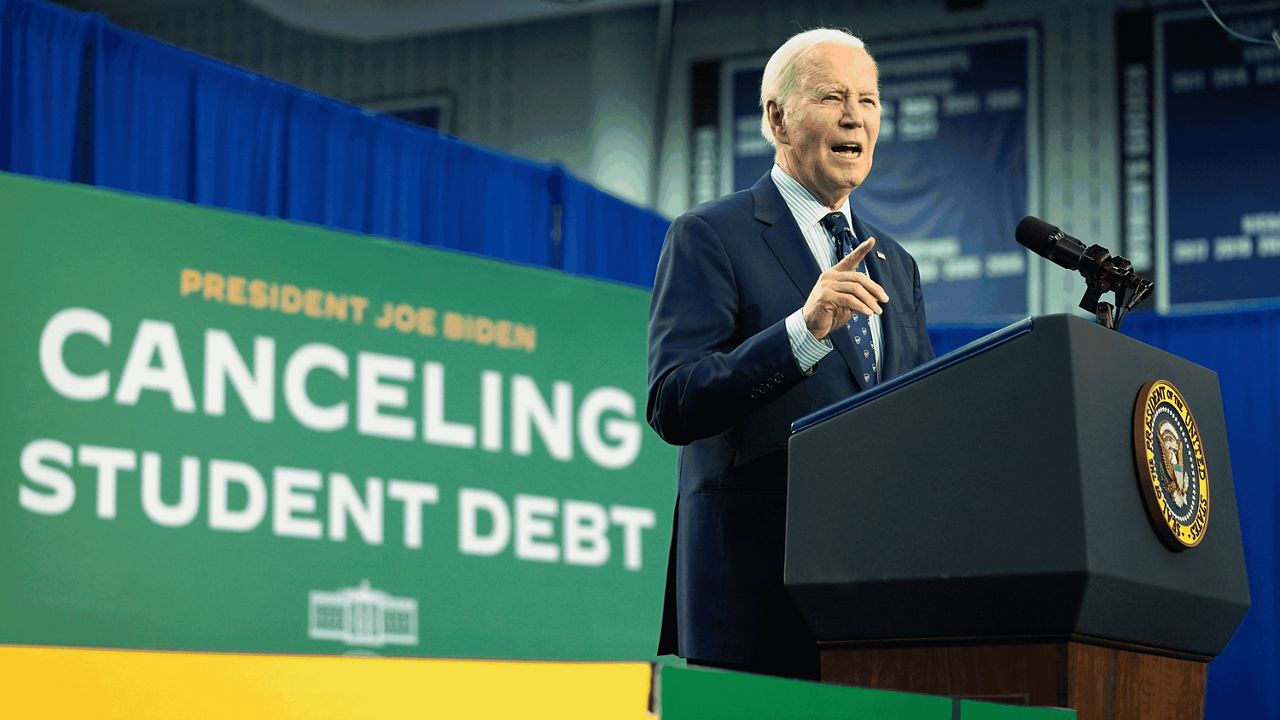

If finalized, the rules would mark a key victory for President Joe Biden, who made canceling student loan debt a major promise on the campaign trail in 2020 but has faced legal battles over his plans to do so while in office.

In total, more than five million student borrowers have received at least some debt relief during Biden’s presidency, the White House says. Just this month, the administration announced it is canceling $4.5 billion in student loans for more than 60,000 public service workers, such as nurses, teachers, police officers and firefighters, bringing the total number of such workers who have seen debt forgiven to more than one million over the last nearly four years.

But the administration has relied heavily on adjustments and tweaks to existing programs to cancel the loans while his more sweeping plans to forgive debt and make monthly payments more affordable have faced significant legal hurdles.

Earlier this month, a federal judge in Missouri halted Biden from moving forward for the time being on his yet-to-be finalized plan to cancel debt for more than 30 million borrowers. It came just a day after a separate federal judge in Georgia decided it could proceed. The plan was expected to be finalized this fall, and the administration said in July it was beginning to email people who may be eligible for relief earlier this summer.

That plan is already whittled down from Biden’s original and wide-reaching proposal to forgive up to $20,000 in student debt for all Americans making under a certain income, which was struck down by the Supreme Court in June 2023.

The new repayment plan, called the SAVE Plan, that Biden also announced in the wake of the Supreme Court’s decision, which sought to lower monthly payments for borrowers, is also held up in legal battles. The so-called “on-ramp” period in which borrowers could not receive harsh financial penalties, such as being reported to credit bureaus or debt collection agencies, if they missed a payment between Oct. 2023 and Sept. 2024, when they were easing back into payments after a three-year pandemic pause has also just ended.

It is unclear whether the new proposals announced Friday will face a similar fate.