The federal government announced Friday that it will restart lease sales for onshore oil and gas drilling on public lands, with a “first-ever” increase in royalty rates for companies to drill.

On Monday, the Bureau of Land Management will once-again issue environmental assessments and sale notices for upcoming oil and gas leases. Included among the changes to the program is an increase in drilling royalty rates to 18.75 percent, which the Department of the Interior said will “ensure fair return for the American tax payer,” and be on par with rates charged by states and private landowners.

According to the announcement, about 144,000 acres of public lands will become available for lease. The sales notices will cover leasing decisions in nine states — Wyoming, Colorado, Utah, New Mexico, Montana, Alabama, Nevada, North Dakota and Oklahoma

The changes come following a report released last November, noting that federal gas and oil lease programs have been unchanged for decades — in particular, onshore royalty rates remained the same for 100 years, at a maximum of 12.5%. Meanwhile, many states charged royalties of no less than 16.67%, while Texas charged nearly doubled the federal rates.

“These antiquated approaches hurt not only the federal taxpayer, but also state budgets, because states receive a significant share of federal oil and gas revenues,” the report said.

According to Taxpayers for Common Sense, the federal government lost up to $12.4 billon in revenue from drilling on federal lands between 2010 and 2019 because royalty rates

Lease sales will also include many recommendations for modernizing drilling program practices, including ensuring Native American tribal consultation and community input, as well as greenhouse gas emission analysis.

Federal onshore drilling accounts for about 7% of domestically produced oil and about 8% of domestic natural gas. There are currently about 37,500 federal onshore oil and gas leases, over 26.6 million acres, being managed by the Bureau of Land Management.

The announcement comes as Republicans pressure President Joe Biden to expand U.S. crude production and rein in higher gasoline prices contributing to record inflation. Biden also faces calls from within his own party to do more to curb emissions from fossil fuels that are driving climate change.

The onshore lease sales will be the first by the U.S. Bureau of Land Management since Biden suspended them just a week after taking office in January 2021, as part of his plan to address climate change.

The administration was ordered last year to resume the sales by a federal judge in Louisiana, who said Interior officials offered no “rational explanation” for canceling them.

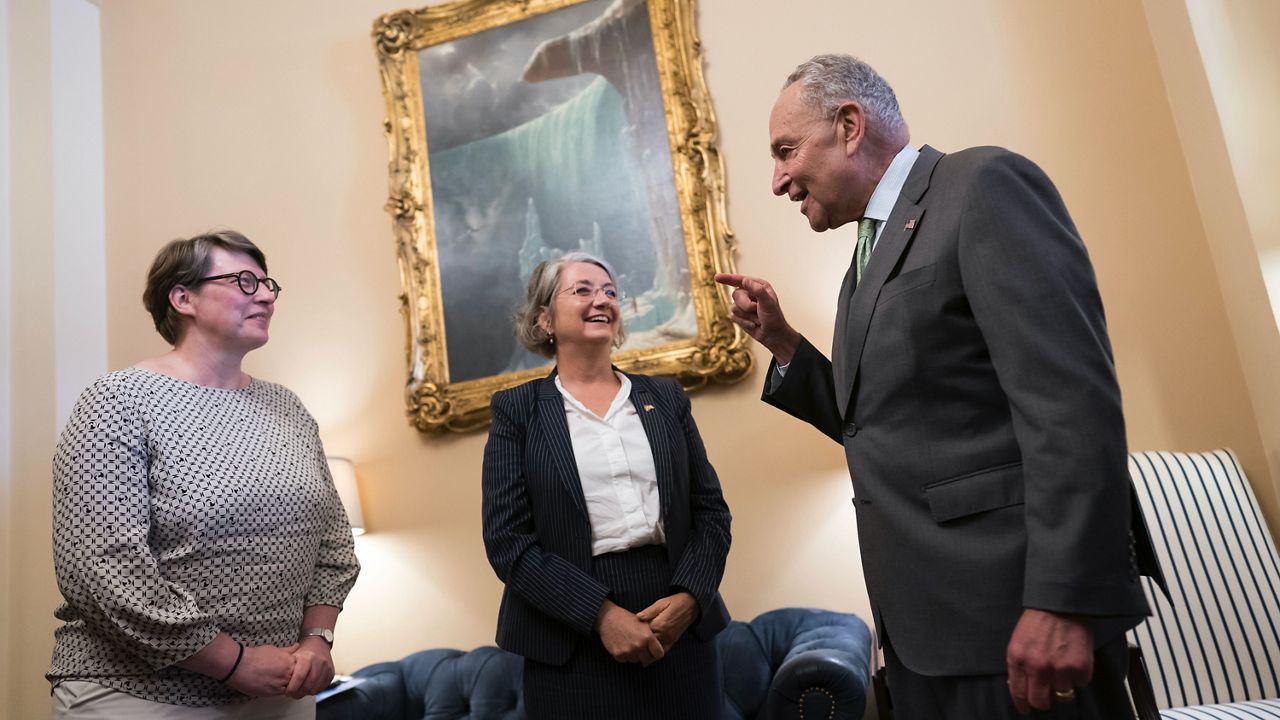

In a statement, Secretary of the Interior Deb Haaland said the federal government has prioritized “the wants of extractive industries” over the needs of local communities, the environment, and the use of public lands for far too long.

“Today, we begin to reset how and what we consider to be the highest and best use of Americans’ resources for the benefit of all current and future generations,” Haaland said.