AUGUSTA — The Mainers for Tax Fairness Coalition is calling on Congress to change the country’s tax structure to better fund schools and health care without cutting social services.

The group gathered at the State House on Tax Day — the traditional tax filing deadline — to speak out against efforts to extend the 2017 federal tax cuts that are set to expire this year.

Costing an estimated $400 billion a year, the groups say they worry that the Republican controlled Congress will cut Social Security, Medicaid, health care and veterans’ services to pay for it.

“It’s a reverse Robin Hood effect and at the end of the day it’s important for folks to know that not only are we talking about tax cuts, we’re talking about how we pay for these tax cuts,” said Garrett Martin, CEO of the Maine Center for Economic Policy.

The coalition is made up of several left-leaning groups, including the economic policy center and Maine People’s Alliance alongside the Maine AFL-CIO, Maine Immigrants’ Rights Coalition and Maine Service Employees Association SEIU Local 1989.

A series of speakers talked about their personal experience with some social services, including MaineCare, the state’s Medicaid program. They also expressed support for state-level tax increases, including urging state lawmakers to pass increased taxes on incomes over $1 million and an increase in taxes on home sales over $1 million.

On Monday, the Maine People’s Alliance called on Republican Sen. Susan Collins to oppose extending the 2017 tax cuts. But in response, a spokesperson said if the tax cuts expire, “every working Mainer will see an increase in money taken out of their paychecks.”

“As a result of the Tax Cuts and Jobs Act, 90 percent of Maine taxpayers received a tax cut,” the spokesperson said via email. “On average, Maine families saw a tax cut of 12 percent.”

In addition, the Collins’ team said she would oppose “any plan to cut Social Security benefits.”

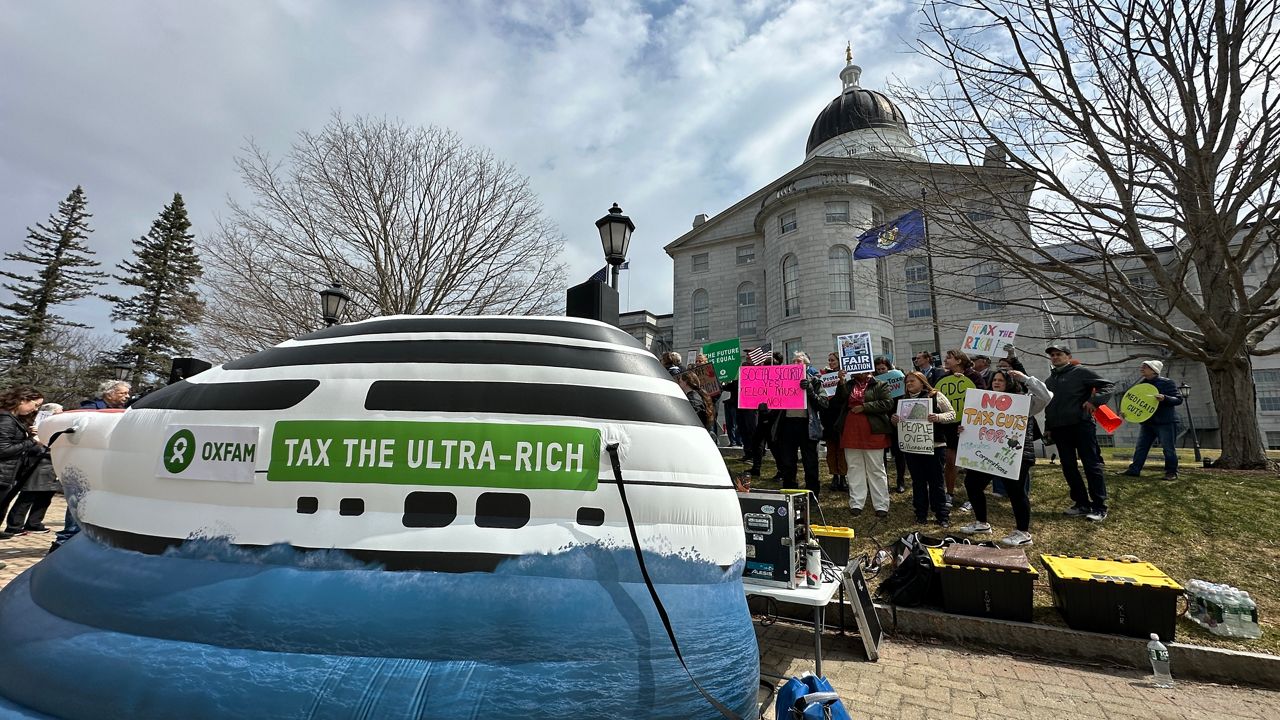

Nevertheless, the coalition planned to march to her office on Tuesday after gathering around an inflatable yacht that called for taxes on the “ultra rich.”

The 2017 tax package reduced the top income tax rate from 39.6% to 37%, nearly doubled the standard deduction and doubled the child tax credit.

For corporations, the tax rate dropped from a high of 39% to 21% and the law reduced or eliminated some business deductions and credits, according to the Internal Revenue Service.

An analysis by the nonpartisan Urban-Brookings Tax Policy Center shows that extending the tax cuts would mean that households making about $450,000 or more would receive more than 45% of the benefits.

Those who make $1 million or more would see their taxes reduced by 3.2% for an average of about $70,000. For middle-income households — defined as about $56,500 to $169,800 — taxes would decline 1.3% for a savings of about $1,000.

Martin said that while most Mainers are currently seeing some benefit from the tax plan, when proposed cuts to pay for it are factored in, average Mainers will be hurt.

Last week, Republicans in Congress passed a budget framework that sets goals for cuts that Martin estimates will result in about a $700 million loss in federal funds coming to Maine. Those reductions could come from Medicaid, food assistance and other programs, he said.

“When you then look at what spending cuts they are going to make in order to pay for these tax cuts, it turns out that at the end of the day, working people are going to see a greater bite out of their bottom line than an improvement,” he said.