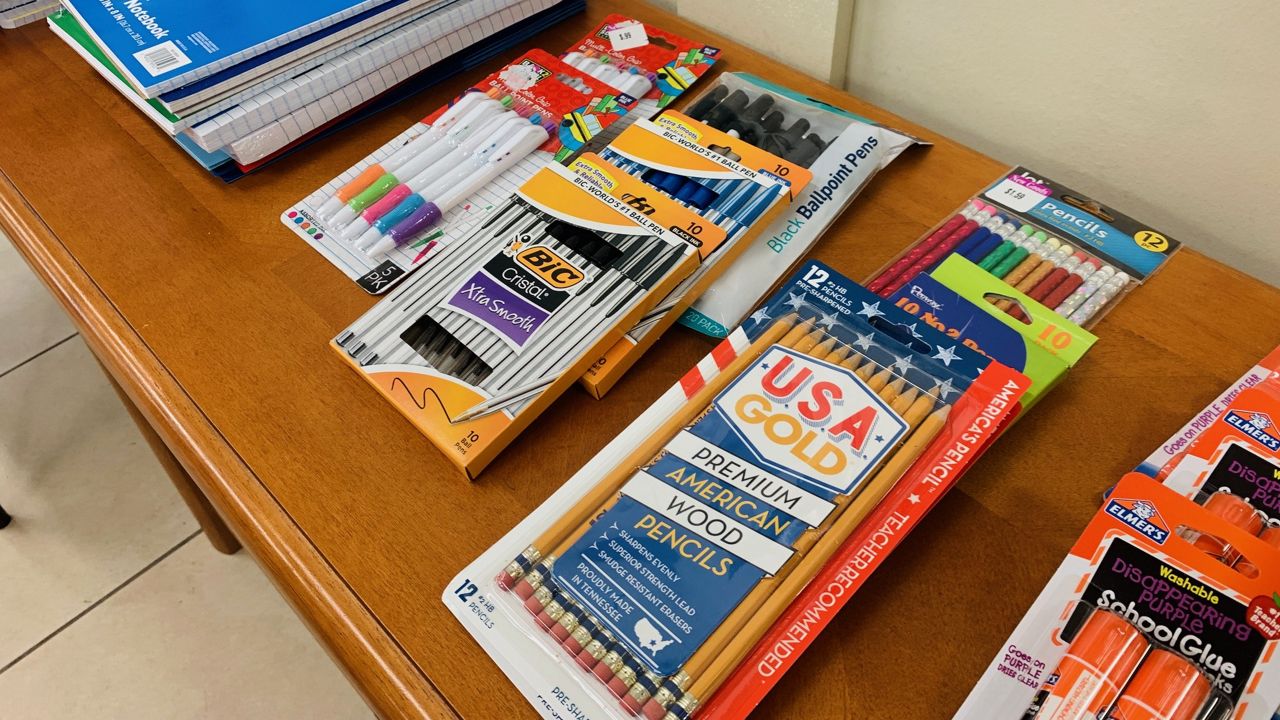

FLORIDA — Families will have the opportunity to stock up on various school supplies tax free as the 2024 Back-to-School Sales Tax Holiday takes place from July 29 to Aug. 11.

During the holiday, shoppers can purchase clothing items, footwear, and accessories with a sales price $100 or less per item, certain school supplies with a sales price of $50 or less per item, learning aids and jigsaw puzzles with a sales price of $30 or less, and personal computers and related accessories with a sales price of $1,500 or less. The tax holiday does not apply to any otherwise eligible items bought within a theme park or entertainment complex, public lodging establishment or airport.

Here's what you need to know about the tax holiday:

- There is no limit on the number of times that items can be purchased tax-free during the holiday

- Items purchased online also qualify for the tax holiday

- Layaway items are also eligible for tax exemption

View more details about the Back-to-School Sales Tax Holiday from the Florida Department of Revenue below: